From time to time, every taxpayer will go head-to-head and toe-to-toe with the IRS. Whether you are setting up an installment agreement, facing the auditor from hell, resolving a misunderstanding, or dealing with collectors on the phone, or worse yet, on your doorstep, you would be well advised to heed the following suggestions.

- You get more flies with honey.

“Answer questions truthfully, but keep your answers short, succinct, and to the point.”

Remember what Mom used to say! Dealing with bureaucracy can be very frustrating, but park your bad attitude and anger at the door. Take a deep breath, demonstrate a cooperative attitude, and proceed in a business-like fashion in resolving your issue. In my 40-some-odd years of dealing with the IRS, I have found that most IRS personnel are compassionate humans that bend over backwards to find ways to settle issues and help taxpayers. It’s true! It’s not as though you won’t ever run into that power-hungry, condescending, surly agent from time to time, but if you do, you can always trade up to a more understanding and respectful model. Just ask for the group manager. - Use IRS lingo.

When you use IRS lingo, the person you are speaking with will find you knowledgeable and may treat you with a little more respect. Here is some verbiage that you may find useful:- Ask for penalties to be “abated” rather than removed.

- Tell them, if it’s the case, that your failure to pay, file or comply with a document request was due to “reasonable cause.” Use this term if you didn’t just flake and have a good reason, which could include such things as unemployment, losing your records, losing your home, health problems, divorce, etc.

- If you can’t pay a tax bill because you are suffering financial reversals, you can ask to be deemed “currently not collectible.” If you are granted this status, they will leave you alone for an entire year while you get it together.

- If you feel a spouse or former spouse should be responsible for a tax matter, ask to be treated as an “innocent spouse.” There are certain criteria to using this status. Do some research and/or discuss the issues with your tax professional.

- If defending business deductions during an audit, the term “ordinary and necessary” business expense will help – but only if that’s really the case.

- Don’t talk too much.

“Tell them, if it’s the case, that your failure to pay, file or comply with a document request was due to ‘reasonable cause.'”

IRS agents are trained to draw as much information from you as possible. Answer questions truthfully, but keep your answers short, succinct, and to the point. There is no need to elaborate or discuss your personal life or disclose too much. This will only lead to misunderstandings and possibly investigations.

- Always tell the truth.

Lies have a way of uncovering themselves. Once you are caught in a lie, you will always be suspect and will lose the cooperation you would normally receive. Don’t hide assets, don’t run for cover. There are many ways to resolve tax problems using a straightforward and honest approach. Lies may also lead to jail time. - Only make promises you can keep.

This is especially true when it comes to paying your liability. If an IRS agent asks you if you can pay $200 per month on a tax balance and you know that you can only afford $100, tell them. Indicate that you will try to pay extra when you can, but don’t set yourself up for failure by promising more than you are able. Throw that in with the fact (if it’s the case) that you have always timely filed and paid liabilities in the past and now you need a break. Note that this will not work if their analysis of your financial situation indicates that you can pay more. - Go to them before they come to you.

If you are unable to keep a promise you make, call them and let them know immediately. They are usually so happy with the cooperation they will likely grant you the extensions you need. The collections department makes a note in your file whenever you or your representative calls. - Stop the Interview.

“If at any time during an audit or a phone conversation you feel intimidated, disrespected, or out of your depth, simply say so and end the interview.”

If at any time during an audit or a phone conversation you feel intimidated, disrespected, or out of your depth, simply say so and end the interview. Tell the IRS that you will be seeking representation and will get back with them soon. This will give you a chance to take a deep breath and discuss the matter with your tax pro. If you feel disrespected, you can always request a different auditor. Or if it’s a matter of a surly customer service rep you encounter on the phone, hang up and call again in hopes of getting someone kinder or a little more understanding.

Always discuss serious matters with your tax pro; this person can provide insight to your specific issue. And know that in these post-COVID days, with huge reductions in staff, there are likely only two or three people left working at the IRS, so be patient.

Please know that the IRS will only contact you via the US mail system. They do not email, fax or phone taxpayers out of the blue. If you are contacted that way, hang up or don’t email back. All emails should be forwarded to phishing@irs.gov.

CONTACT US for help with your IRS issues or more information.

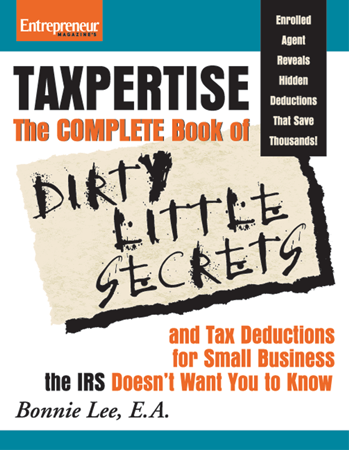

Bonnie Lee is an Enrolled Agent and owner of Taxpertise, Inc., located at 450 2nd Street West, Sonoma, CA 95476.